🧱 A Bricklayer's Blueprint for Getting Out of Debt

How One Tradesman Found Two Paths—and Chose the One That Built His Future

Frank's hands were rough, his back was sore, and his boots were dusty by 5 p.m. every day. But what really weighed on him wasn't the cinder blocks he stacked for a living—it was the $9,000 in credit card debt hanging over his head like a scaffold ready to fall.

He had just enough breathing room each month — about $600 extra after bills — but he wasn't sure what to do with it. His buddy Pete said, "Put it all on the card and get rid of it." Another guy at the shop warned, "Save it. You never know when your truck's gonna crap out."

Frank felt stuck between two walls with no door in sight.

That's when someone showed him a different way of looking at the problem. A blueprint.

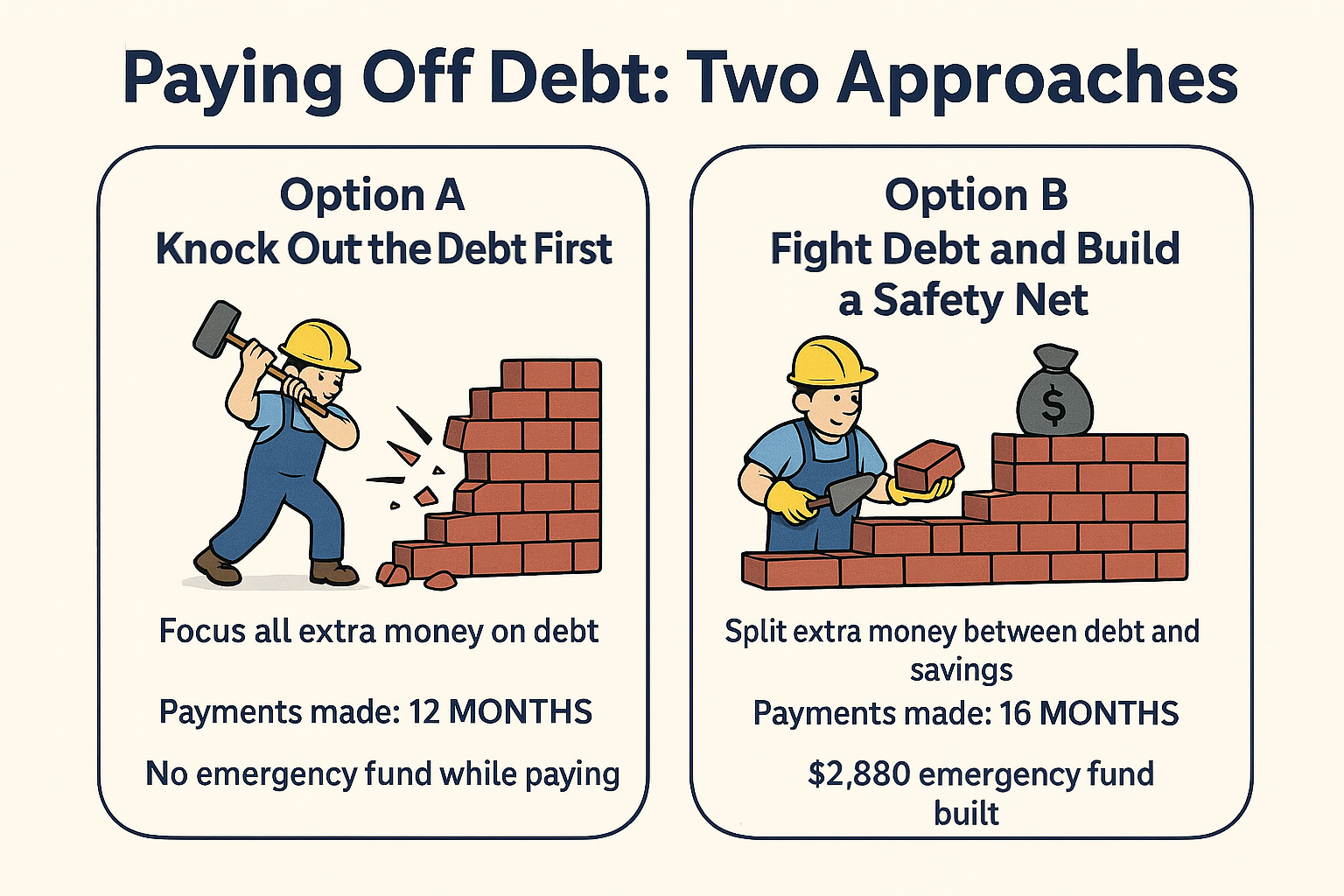

🧭 Two Plans — One Goal

Plan A: Go All In on the Debt

Frank could throw all $600 each month at the credit cards. Between that and his regular $240 minimum payment, he'd be paying $840 a month total.

And sure enough, that would wipe out the whole $9,000 in exactly 12 months. Boom. Gone.

But during that whole year, if anything went wrong — the truck, the tools, a slow work week — Frank would have nothing in savings. He'd be right back to swiping that card again.

Fast, yes. But risky.

Plan B: Pay Down Debt While Stacking a Safety Net

This one felt more like how Frank worked on the job: a solid foundation, one brick at a time.

- Put $420 toward the card (on top of the $240 minimum)

- Save $180 each month into an emergency fund

With that plan, the debt would take a little longer — 16 months instead of 12 — but by then, he'd also have $2,880 saved up. If the truck needed repairs or the union called a slow month, he'd have something to fall back on without reaching for the credit card again.

Two paths. One goal. Which approach builds what you really need?

🛠️ The Right Tool for the Job

Frank went with Plan B.

Why? Because he didn't just want to get out of debt — he wanted to stay out.

He knew from experience that rushing a job with no backup plan usually leads to doing it over again.

Same with debt.

Now, with a little patience and a plan, Frank's not only digging out of the hole — he's building something solid on top of it.

💡 Your Turn

If you're staring down debt and wondering which way to go, just ask yourself:

or steady and protected?

There's no wrong answer — but there is a smarter one, especially if you want this to be the last time you ever deal with credit card debt.

And if you want help running the numbers and building your own plan, check out ZilchWorks. It's the tool that lays out your blueprint — just like Frank used.

Because when you're out there laying bricks for everyone else...

You deserve to build something for yourself, too.

🚨 What If You Do Nothing?

- $9,000 turns into $15,000 with interest — all while doing nothing.

- One bad week on the job, and you're right back to swiping that card.

- No savings? One busted tool or slow month could wipe out everything.

- $150 a month just vanishes — for nothing.

🧱 Ready to Lay the First Brick?

No loans. No gimmicks. Just a solid plan built brick by brick — and it works.

Try It Free Buy Now