Minimum Payment Calculator FREE

See how much your credit card is really costing you!

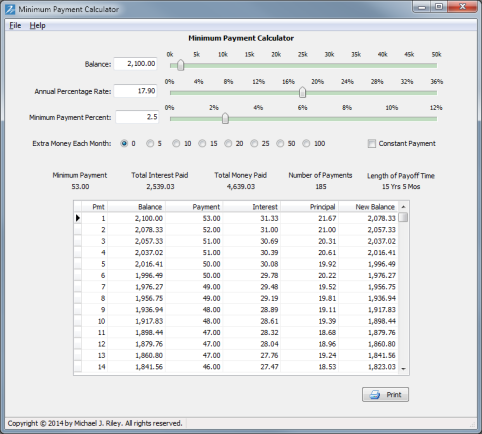

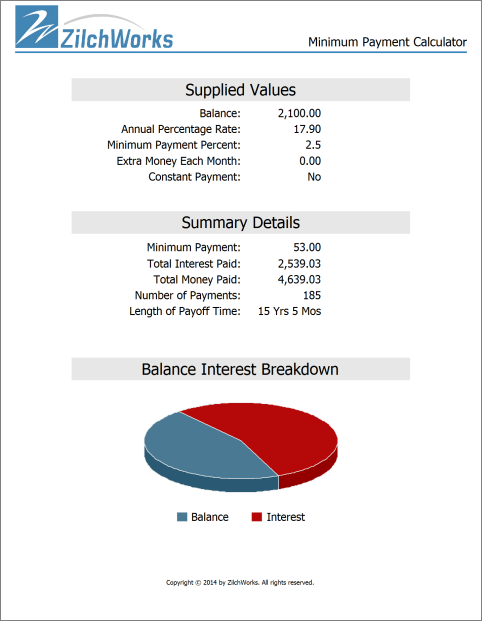

Get instant feedback on the true cost of your credit cards. Our free Minimum Payment Calculator features slider bars that let you play out multiple "what-ifs" in a fraction of a second. Instantly see what happens when you add 5, 10, 20 or even 100 extra to your payment each month. The feedback is instant and the savings is truly amazing. Check out how much you will save by taking advantage of the low-rate credit card offer you just received.

❝I'm going to use ZilchWorks to pay off my mortgage and get out of debt as fast as I can.❞

I have a goal, which is to retire soon and spend time with my 2 awesome grandsons, ages 6 and 8. You are going to help make that happen because I'm going to use ZilchWorks to pay off my mortgage and get out of debt as fast as I can.

Marlena B. - Canton, Texas

I originally learned about your software from a friend who uses it. She swears by it! In the past I have used a debt management company to pay off $32,000 of credit card debt, and am paying my last $1,000 on those cards. It has taken 8 long years. I wish I had known about this program before paying that company $45 a month to do what I could have done myself in a shorter length of time.

Thank you for creating this awesome software. God bless you.