Step 5 - Make the monthly payments.

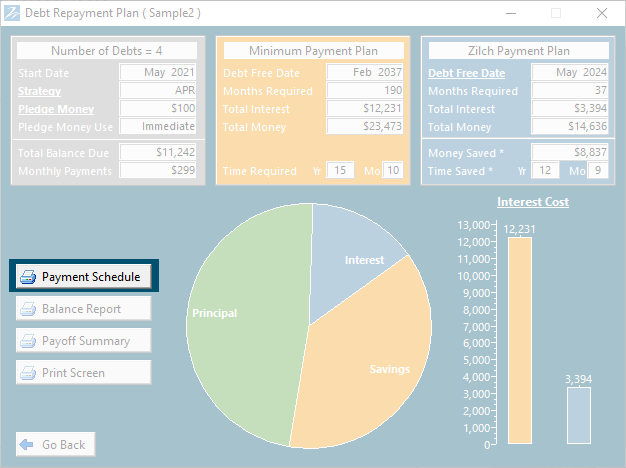

Print your Monthly Payment Schedule by clicking the Payment Schedule button on the Debt Repayment Screen.

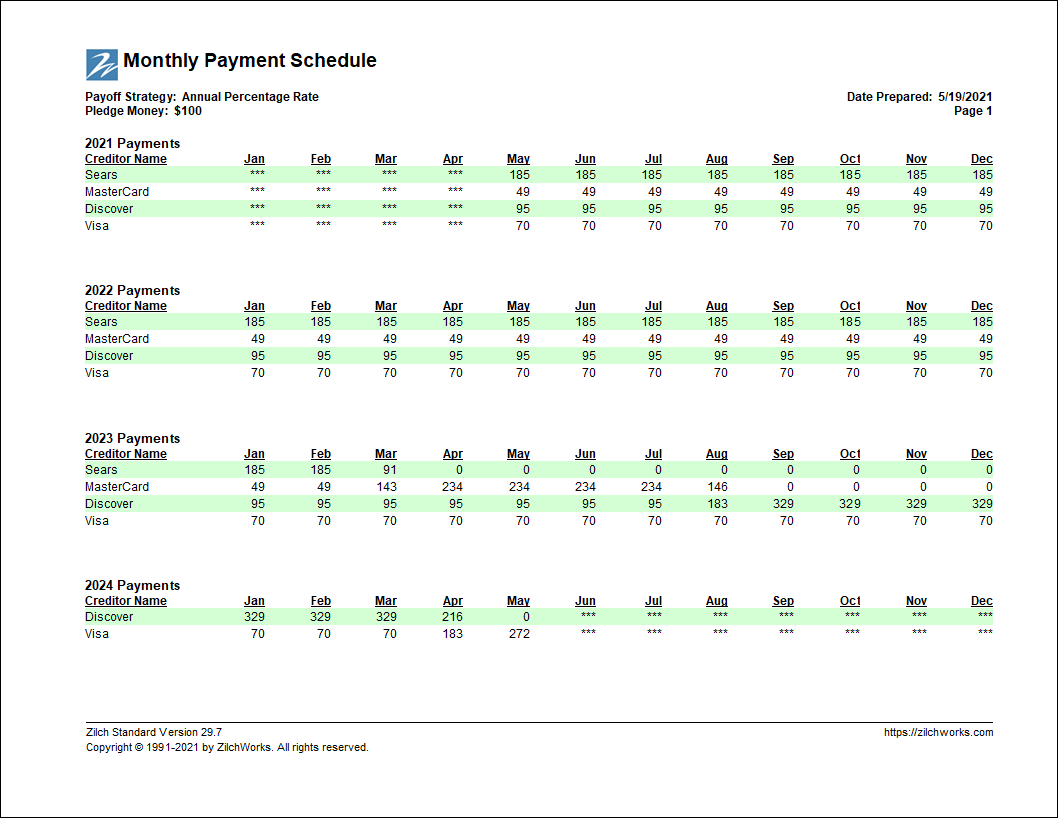

The Monthly Payment Schedule is your yellow brick road. Each brick represents a monthly payment. These monthly payments have been carefully layed out to ensure you get out of debt as fast as possible. You follow the yellow brick road by making each payment.

The Monthly Payment Schedule is your yellow brick road. Each brick represents a monthly payment. These monthly payments have been carefully layed out to ensure you get out of debt as fast as possible. You follow the yellow brick road by making each payment.

Transitions:

Along the way you will encounter transitions. Transitions are good things. A transition happens when the last payment is made to a creditor. When a creditor is paid off, it frees up some money. That freed up money gets shifted to the next creditor. This shift is called a transition.

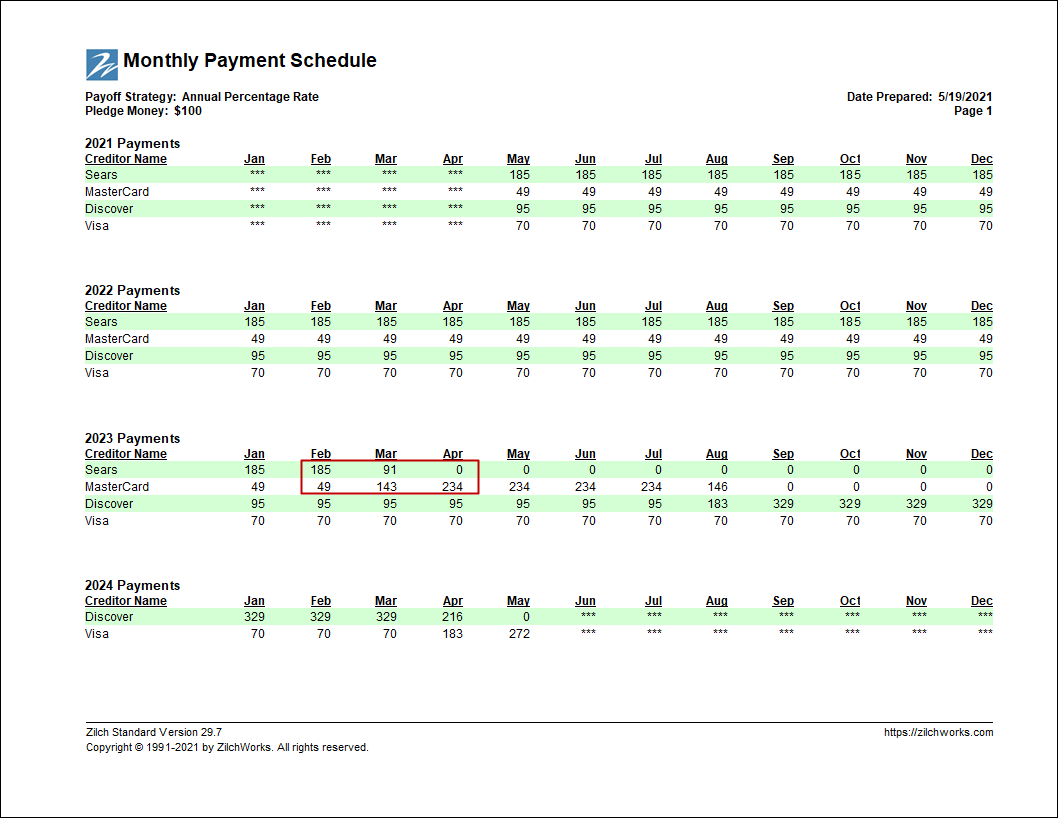

The first transition is shown by the red outlined section below. The monthly payment going to Sears gets shifted to MasterCard. It is partially shifted in March because Sears has a smaller last payment. It is fully shifted in April because Sears is now completely paid off.

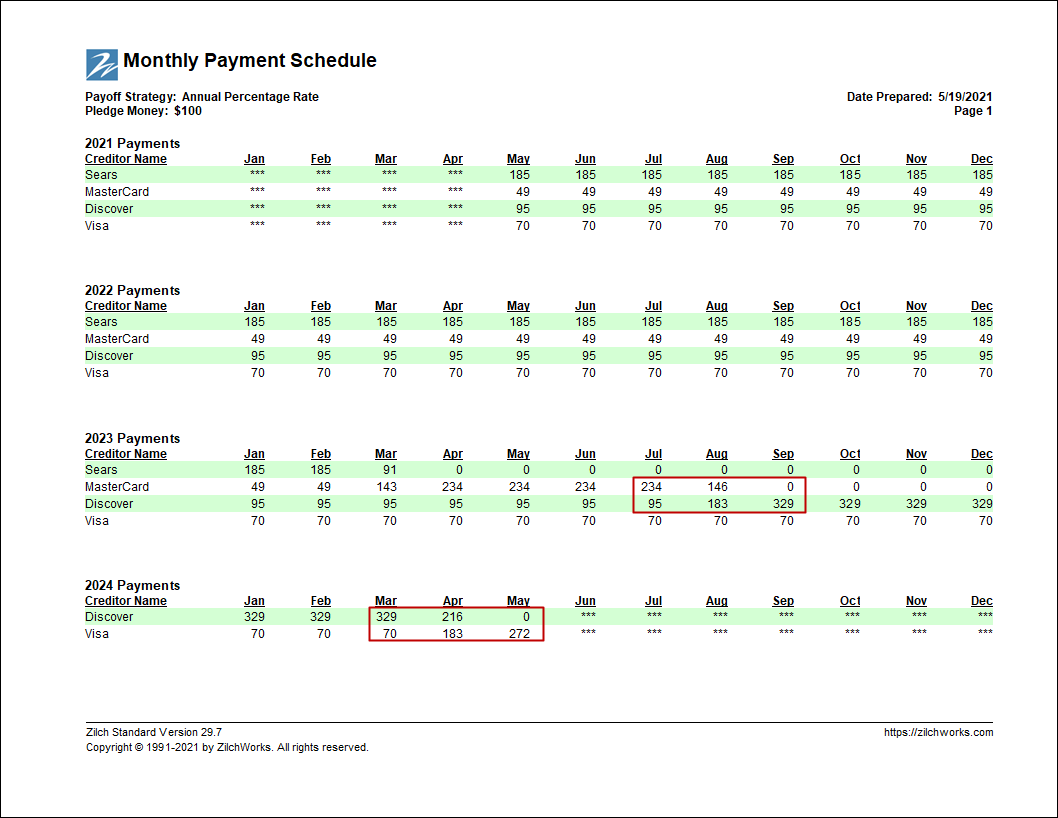

The second and third transitions are highlighted below. The monthly payments from paid off accounts are shifted to the next priority debt.

These transitions form what is called a payment snowball. This video, taken from Credit Card Math, explains the concept of payment snowballing and demonstrates how the transitions are created.

❝Thank you. Your program helped me get out of debt fast.❞

I was looking through my cancelled checks to shred old records and found a check to you for Zilch written on 10/3/1999 for $34.00. Money well spent.

Rodney Nibbe - Minnesota

Thank you. Your program helped me get out of debt fast. Shortly after I started using Zilch I was eligible to buy a house and have almost never carried a balance into the next month.

Thanks again.