HOW ZILCH WORKS

The secret to getting out of debt fast is using a payment strategy. The strategy you choose is based on what makes you feel good. This gives you immediate relief because you will stay in your comfort zone from day one.

The two most common payment strategies for getting out of debt are Avalanche and Snowball. Avalanche prioritizes paying off debts from the highest interest rate down to the lowest interest rate. Snowball prioritizes paying off debts by those which can go away the quickest. Choose the payoff strategy that makes you feel good.

| How I Feel | Strategy |

|---|---|

| I'm a numbers person. Numbers make sense to me. | Avalanche |

| I am not a numbers person. Numbers scare me. | Snowball |

| I want to save the most money no matter what. | Avalanche |

| I want to get out of debt as fast as possible. | Avalanche |

| I'm looking for fast results. I like to see progress. | Snowball |

| I need lots of encouragement along the way. | Snowball |

ZilchWorks takes all the information about your debts (balances, interest rates, monthly payments) and instantly turns it into a realistic payoff plan using the payoff strategy that you feel good about. You'll see exactly how much to pay each credit each month. This short video explains how the payment strategy works.

Step 1 - Make a List

Believe it or not, this is the hardest step. Why? Because it forces you to act. It makes you look at your debts. It requires you to acknowledge how much money you owe. This may be something you have wanted to do for a long time but kept putting off. We can only help you if you are willing to help yourself. There has never been a map produced that just takes you where you want to go. You must act. Until you make a decision to act, and follow the map, it's nothing more than lines on paper. Take that first step... print the worksheet and fill it out.

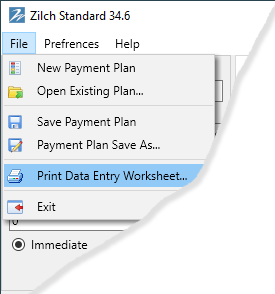

Click File > Print Data Entry WorkSheet... to use the built-in data entry worksheet.

Important: When you write down your debts don't try and prioritize the pay off order. Our software will do this for you. Just concentrate on finding your debts and getting them listed on the worksheet.

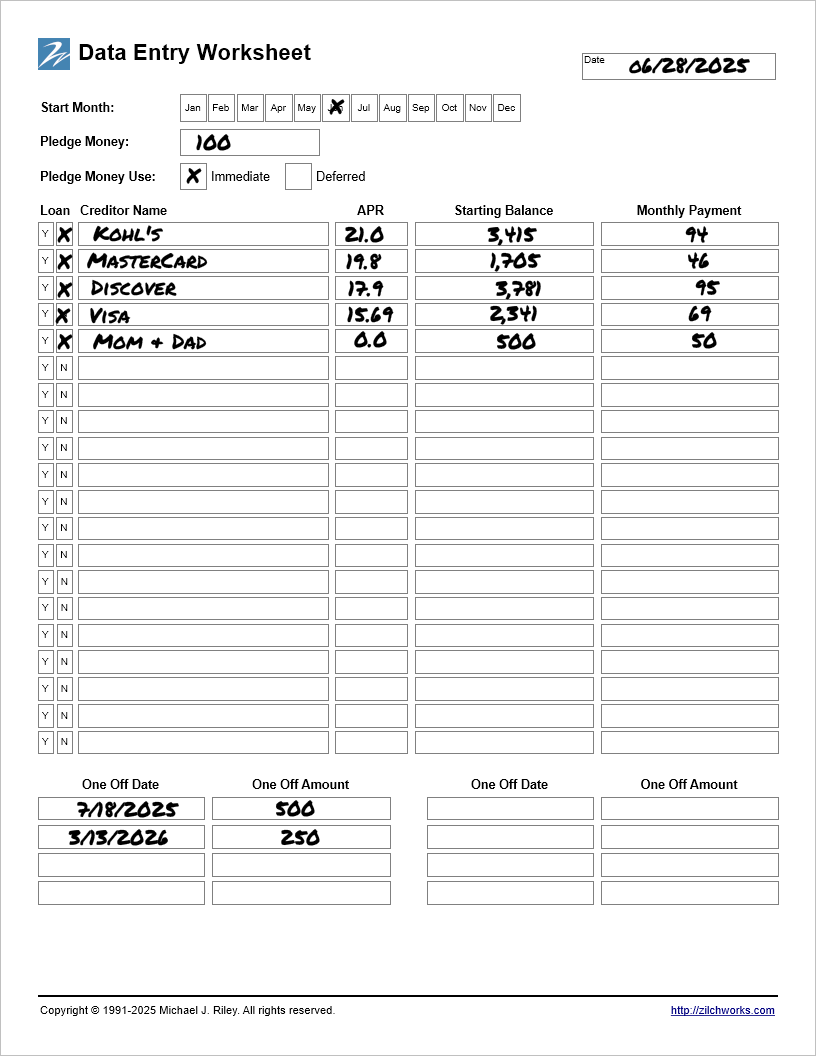

Example of a completed worksheet:

Here is an example of a completed data entry worksheet. These are the actual debts from the Sample2 file included in the software download.

❝It is almost laughable at how fast and easy it is to get this paid off.❞

After being trapped by the vultures in the credit card industry, I followed your advice and have started to make progress paying off my debts. I never knew about the ways these vicious companies keep a consumer paying for years and years. You have really opened my eyes to this problem.

Robert Gardner - Georgia

I have followed your advice for 15 months. My minimums are so low its shocking but I keep making the amount I set up. It is almost laughable at how fast and easy it is to get this paid off but without your help, I never would have been able to do this. Thanks again Mike. Keep doing what you're doing. And I hope you get rich and famous and live a fantastic life.